PolicyFly is an all-in-one digital platform that’s revolutionizing insurance administration. We help insurers build better, more-profitable programs with streamlined online applications, faster and smarter underwriting, and the best technology money can buy. In the time I have been the UI/UX lead with PolicyFly, I have worked with the broader team to launch a number of new lines of business as well as improve the overall platform experience with new features and user-centered enhancements.

Collaborators

- PolicyFly Product

- PolicyFly Engineering

Deliverables

- Product Research

- User Experience Design

- User Interface Design

- Design System Development

Client

Year

2018 – Present

A Material Design system that ensures consistency for customers and developers

The PolicyFly brand lives across a number of channels, requiring a robust design system to ensure it communicates effectively in print, digital advertising and various digital platforms. Using Material Design principles as the foundation, the carefully structured design system ensures design and engineering can align to deliver a consistent brand experience for customers from first adoption to application and renewal.

Primary Brand Colours

Brand Blue

#4A90E2

Dark Brand Blue

#3876BF

Primary Navy

#1A3056

Dark Navy

#182C4F

Brand Accent Colours

Orange

#F2A547

Burnt Orange

#EC5D35

Magenta

#D3145E

Mauve

#9B1C63

Purple

#61308A

Royal

#147AB9

User Feedback Colours

Success

#55D19A

Success Dark

#3EBE85

Warning

#FCC35B

Warning Dark

#EEAB32

Error

#F17F74

Error Dark

#D6574B

H1

Welcome to PolicyFly

H2

Explore Coverages

H3

Review Policy Details

H4

Auto Liability Loss Experience

H5

Any Losses Greater Than $100,000 in the Last 5 Years?

H6

346 Madison Ave (44th St), New York, New York, 10017

Body Sub-headings

Description of Operations

Body Copy

All drivers (including drivers using their personal vehicles for any company business) must have annual MVR's reviewed and no drivers under 25 or over 70; drivers cannot have more than 1 moving violation in 3yrs. and no major violations in 5 years. Driver that has DUI on record is unacceptable. A driving record for the past five (5) years with a major violation and three (3) years for all other violations. These Drivers must be excluded or placed in a non-driving position. A driver limitation endorsement is allowed in places on a driver in any state that does not allow driver exclusions. All drivers must carry minimum financial responsibility limits and not contain a work use exclusion on their policy.

Body Links

Learn More

Text Buttons

CLICK HERE

Distilling complex paper based policy lifecycles to one intuitive digital experience

The platform is designed to give your team complete control over the policy lifecycle. From rate and quote to issue and renewal, PolicyFly makes it simpler, quicker, and more profitable for customers. The continually evolving feature set offers complete policy management, automated programs, seamless distribution, and enhanced service all in one place.

Tailored LOB Landing Pages

Tailored segment specific landing page funnels help to advertise and create awareness of new lines of business the platform offers. From automotive to home and maritime insurance, these targeted pages drive businesses’ first step towards adopting the platform as their preferred method of policy management.

Smart Application Forms

Smart fields and forms help agents drive more business, faster. Obsessively designed and engineered to create seamless online applications and submissions, these forms utilize strategic 3rd party data partnerships to effectively predict what agents will enter driving higher and faster completion rates.

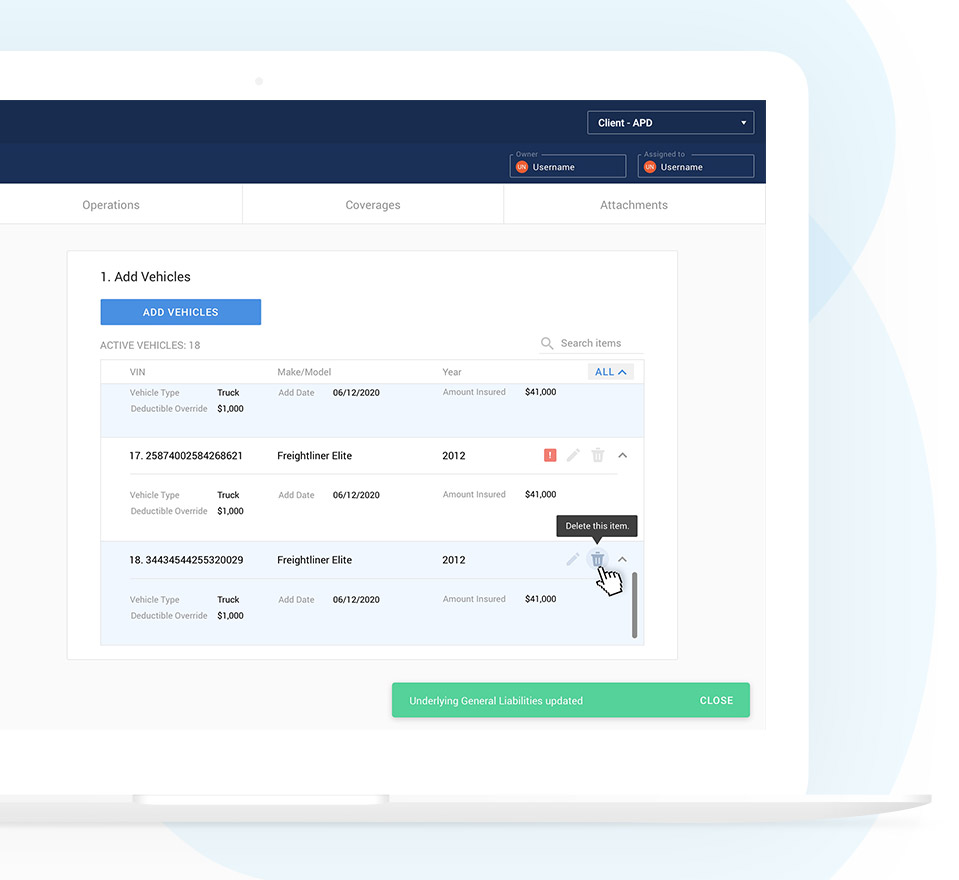

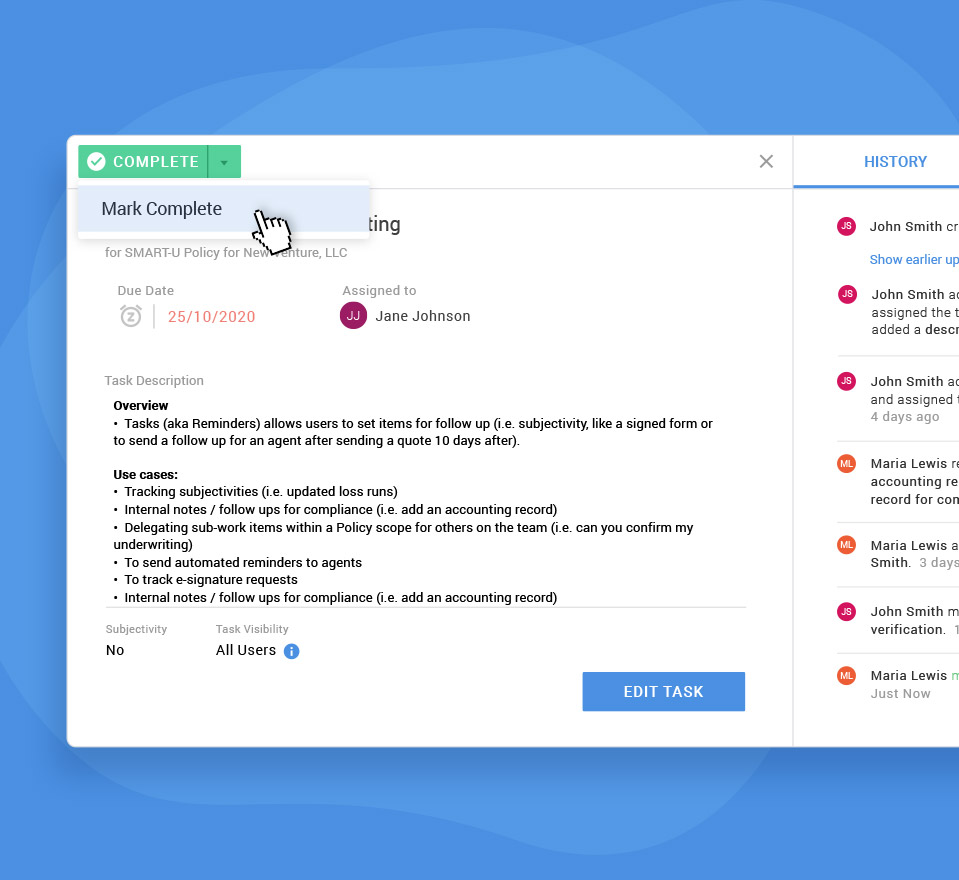

Application Activity Dashboard

The application activity pages offers users complete oversight and history of their workstreams. Powerful history logs show where each policy stands at any point in time, while the tasks feed allows users to assign work and set reminders. These parallel feeds ensure users no longer have to dig through emails to understand the status and history of their active applications and policies.

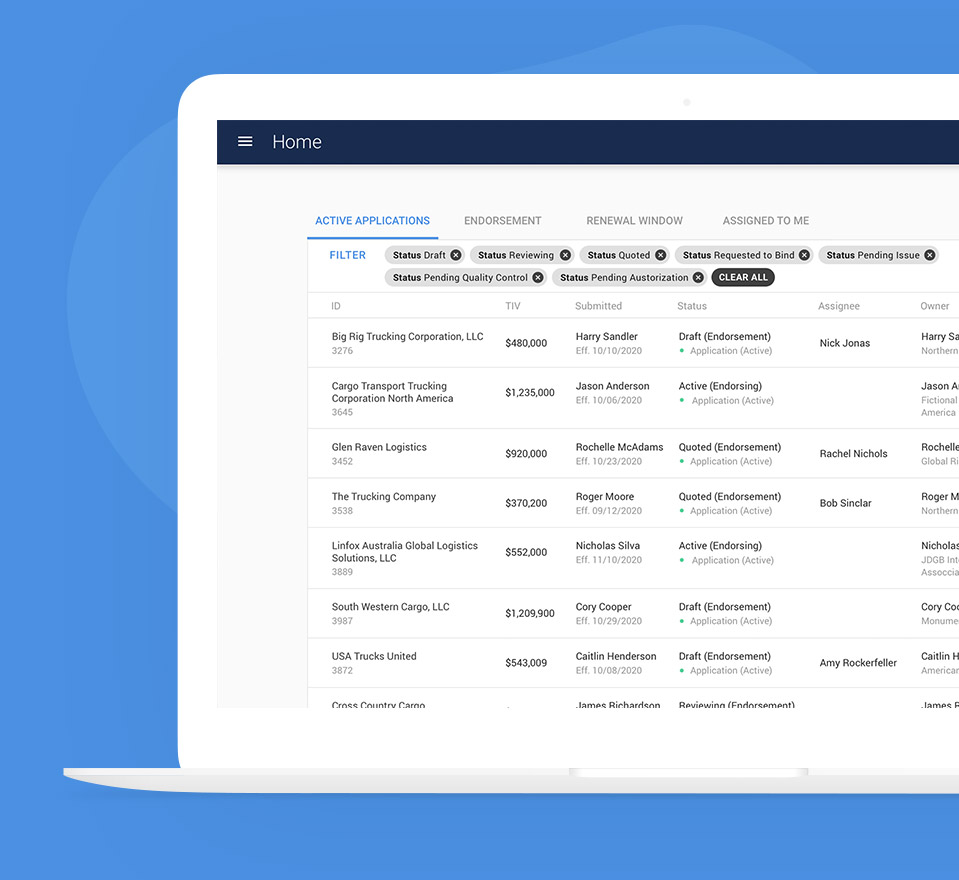

Real-Time Business Tracking

The application dashboard allows users to track retention, loss and bind ratios and much more in real-time. Designed to incentivize agents with commission tracking and gamification elements, the dashboard provides a clear overview of the change in application efficiency over time.

Sophisticated workflows driven by simplicity and accountability

The ability to track the status of applications and tasks associated with them empowers users to collaborate on their progress. The quote adjuster allows agents to automatically hit their target premium by controlling parameters the customer underwriting team defines. Application diffs and “one click” renewals help users to quickly review their policy lifetime and efficiently edit and progress it.